Research & development is a key engine of economic growth and competitiveness for many nations, including Australia.

It can develop new products or improve existing ones and improve the efficiency of an industrial process, allowing companies to survive and thrive in competitive international markets.

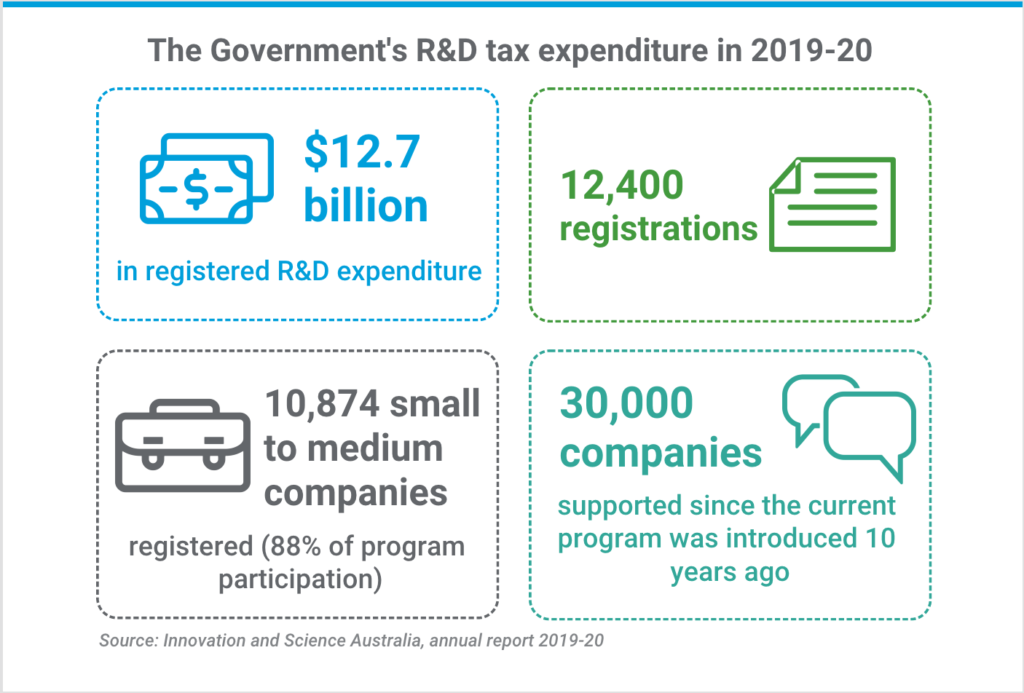

In Australia, the R&D tax incentive was introduced in 2011 to encourage innovation. Since then, tens of thousands of Australian Startups and SME’s developing new and exciting technologies, processes and products have utilised the incentive which provides:

- a 43.5% refundable tax offset for eligible entities with an aggregated turnover of less than $20 million per annum, provided they are not controlled by income tax exempt entities,

- a 38.5% non-refundable tax offset for all other eligible entities.

Gold Coast Innovation Hub partners, RSM are experts at advising and assisting startup founders to claim the R&D tax incentive.

They have reviewed the last 10 years of the R&D tax incentive and prepared a new report that follows the evolution of this business benefit and opportunities for further reform. Download your copy of the report here.